unrealized capital gains tax bill

For singles the current exemption is 250000. Long-term capital gains tax is a tax applied to assets held for more than a year.

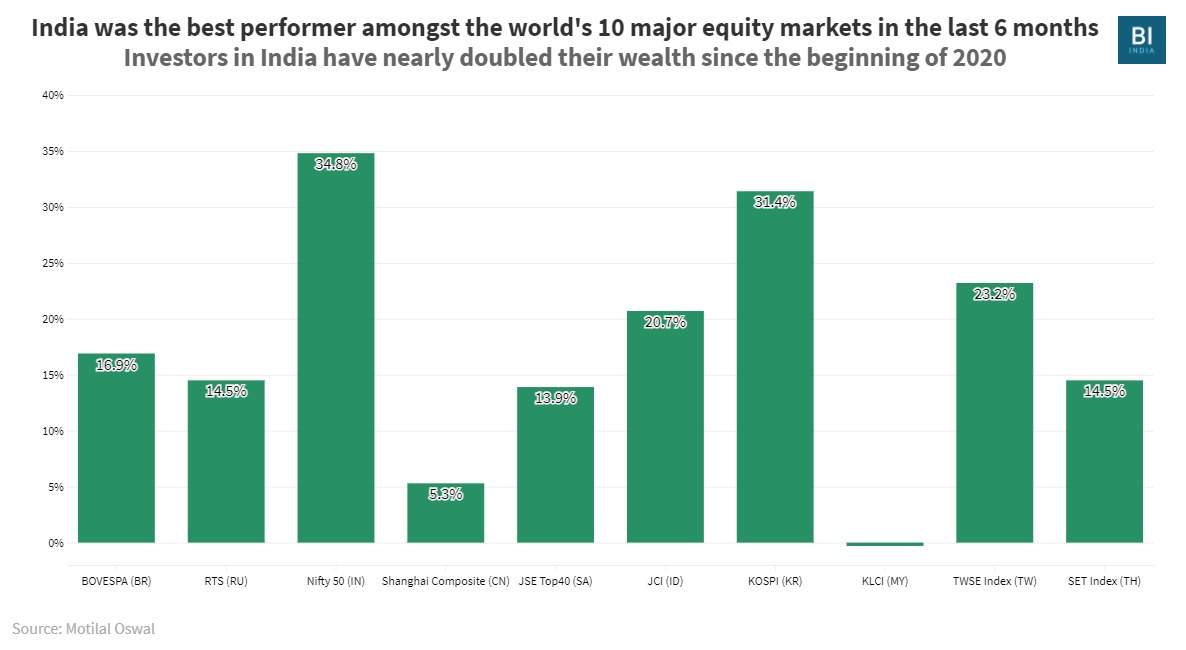

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

Long-term gains are taxed at a reduced capital gains rate.

. This is great news if your house hasnt appreciated more than. The first and easiest way to lower your capital gains burden is to take advantage of the capital gains tax exemption. Create a Tax on Net Worth the Billionaire Tax A tax on wealth functions by taxing asset gains.

If your taxable income is less than 80000 some or all of your net gain may even be taxed at zero percent. There are a few exceptions where capital gains may be taxed at rates greater than 20 see IRS Topic 409. The capital gains tax on most net gains is no more than 15 percent for most people.

Unrealized losses are on paper only and not a reportable tax transaction she said. This occurs in years when youre in the 0 capital gains tax bracket. Tax on Investments.

Unless the treatment of capital gains changes under the budget reconciliation bill the tax rates will be the same in 2022 as they are for. Long-term capital gains are gains on investments held for more than a year. The long-term capital gains tax rates are 0 percent.

Capital Gains Tax Breaks Dont Drive State Economic Growth. Capital gains tax on stocks is a fee investors pay when selling shares for more than the purchase price. The Capital Gains Tax Exemption.

Proponents of capital gains tax breaks often argue that they spur economic growth by encouraging investment. Capital Gains Tax Tax-Loss Harvesting. Higher income taxpayers may also be subject to the 38 Net Investment Income Tax on their gains or other income.

They are subject to a 0 15 or 20 federal tax rate based on your level of taxable income. That means that the tax wont apply to the first 250000 of your capital gains. Democrats also considered an increase to top long-term capital gains tax rates from 20 to 25.

Harvesting capital gains is the process of intentionally selling an investment in a year when any gain wont be taxed. Your investment decisions could impact your tax bill. Investors are likely to incur some amount of capital gains tax.

The 0 long-term capital gains tax rate has been around since 2008 and it lets you take a few steps to realize tax-free earnings on your investments. Learn about the basic rules and some strategies to help maximize after-tax returns and potentially reduce the amount you owe. If you want to take this capital loss on your tax return you would have to sell the investment.

These rates 0 15 or 20 at the federal level vary based on your income. As of 2021 the long-term capital gains tax is typically either zero 15 or 20 percent depending upon your tax bracket. Capital gains tax applies not only to individual stocks but also to investment funds such as mutual funds and exchange-traded funds ETFs.

But historically there is no obvious connection between tax rates on capital gains and economic growth at the national level tax policy expert Leonard Burman notes.

I Chose This Image To Represent Management Operating Agreements This Image Displays That An External Management Compan Management Company Management Incentive

Here It Is Wyden S Unrealized Capital Gains Tax On Wealthy Americans Swfi

How To Reduce Capital Gains Tax Liability For The Year

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

The Coming Tax On Unrealized Capital Gains Nomad Capitalist

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Capital Gains Yield Cgy Formula Calculation Example And Guide

Bitcoin Gains Can Become Tax Free Cryptocurrency Investing In Cryptocurrency Bitcoin

Long Term Capital Gain Tax On Shares Learn By Quickolearn By Quicko

High Class Problem Large Realized Capital Gains Montag Wealth

The Billionaire Tax Proposal A No Good Awful Terrible Idea Youtube

How To Calculate Capital Gains On Sale Of Gifted Property Examples

How Much Does A Comprehensive Financial Plan Actually Cost Https Www Kitces Com Blog Average Financial Plan Fee H How To Plan Financial Planning Financial

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)